Municipal bond calculator

If you are seeing this message it is because important work is in progress to bring you faster and more reliable systems with new features requested by users. It was launched to reduce the demand for physical gold and with an aim to invest a part of these physical gold bars and coins that are purchased every year into financial savings in the form of gold bonds.

Yield To Maturity Ytm Formula And Bond Calculator

8 2022 at 325 pm.

. Investment-grade short-term bond funds often reward investors with higher returns than government and municipal. Retirement plan income calculator. They tend to pursue a set maturity strategy long term or short term.

Stripped Municipal Bonds Zero Coupon Bonds. Savings bond the US. Some municipal bonds have the advantage of being exempt from federal taxes.

Using the 1000 example if a bond has a 3 coupon the bond issuer promises to pay investors 30 per year until the bonds maturity date 3 of 1000 par value 30 per annum. Overview of Retirement Plans Calculators. The Authority is upgrading its online information systems.

Municipal Bonds and Taxes. Best high-yield municipal bond fund. Assist communities to construct and fund sustainable infrastructure that protects water quality and public health.

SYSTEM MAINTENANCE IN PROGRESS. If you own or are considering purchasing a US. 833 x 6 percent market rate 4998.

The charges are the first brought by the SEC under a new municipal bond disclosure law. Nuveen High Yield Municipal Bond Fund. The NutFor example take a bond that matures in 10 years with a face value of 100.

Our issuer tools have made BondLink the go-to resource for sophisticated issuers looking for an edge. By contrast if you purchase a 1000 bond with an interest rate of 5 percent and rates fall to 4 percent your bond will increase in value until they can be purchased at a price that will result in an interest rate that approaches 4 percent. Working for David Lerner Assoc.

That means the corporate bonds would generate 35000 in interest income each year for you upon which to live pay your bills keep food in the pantry and medicine in the cupboard. Chinese bond market also includes Policy Bank Bonds. Roth IRA calculator.

China Treasury Bonds are usually placed on the stock exchanges and on the National Interbank Bond Market. The Sovereign Gold Bond Scheme was introduced in the Union Budget 2015-16 by the Union Cabinet which was chaired by PM Narendra Modi. Department of Treasurys Bureau of the Fiscal Service has designed a useful tool for determining the present and future value--as well as historical information current interest rate next accrual date final maturity date and year-to-date interest earned.

American High-Income Municipal Bond Fund Class A Fund 40 AMHIX seeks to provide a high level of current income exempt from regular federal income tax. Investing Best Municipal Bonds. The tax-free municipal bonds on the other hand would generate 25000 per year in interest income.

Reduced bond value. Spend It or Save It Calculator. If you bought this bond for less than 975 you would be required to pay ordinary income tax on the discount.

Education Planner Careers. The local government authority issues bonds in order to finance a capital project within the municipality. A municipal bond is an investment that is issued by a municipality which is usually a local government authority.

You would have to pay ordinary income taxes on this money. The Municipal Finance and Construction Element MFCE is responsible for administration of a number of state and federally funded programs for the planning design andor construction of wastewater drinking water and stormwaternonpoint. The de minimis breakpoint on this bond is 975 100 025 10 years.

BondLink provides municipal bond issuers with easy-to-use investor relations websites custom roadshows and investor analytics to help drive demand for their bond sales. Bond mutual funds may be actively or passively managed funds typically follow a particular type of bondcorporate or municipal. The public sector of China bond market also includes short-term and long-term debt instruments of Peoples Bank of China and municipal governments bonds.

100x Options Profit Calculator. Taxes and Inflation. The agency said the four brokers sold new issue municipal bonds without obtaining required disclosures for.

A closely watched bond-market gauge of near-term inflation expectations has fallen below the Federal Reserves 2 target for the first time in two years. Known as the Savings Bond Calculator it can help you make.

1

1

Bond Price Calculator Exploring Finance

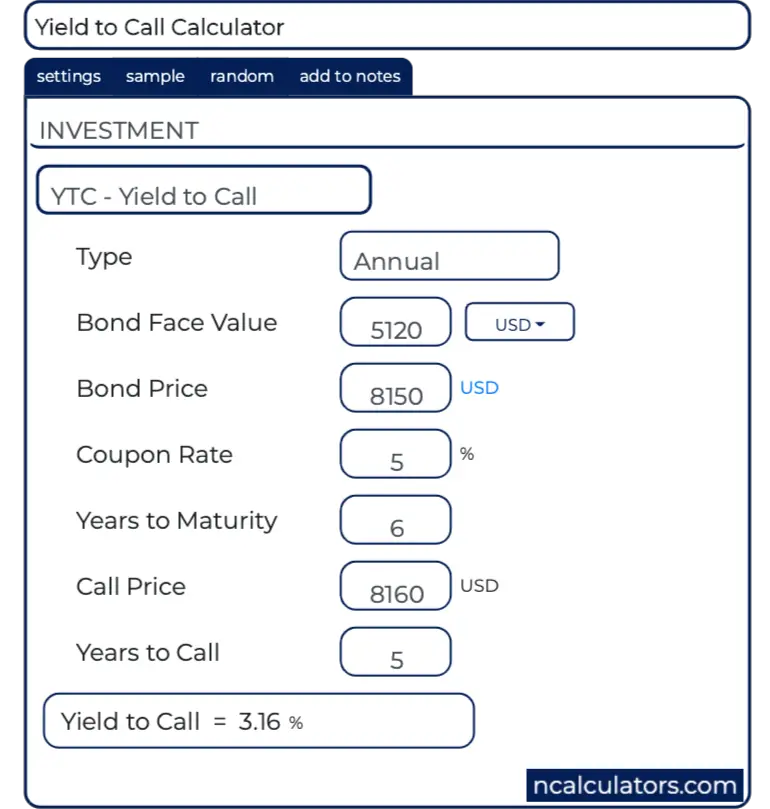

Yield To Call Ytc Calculator

3

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

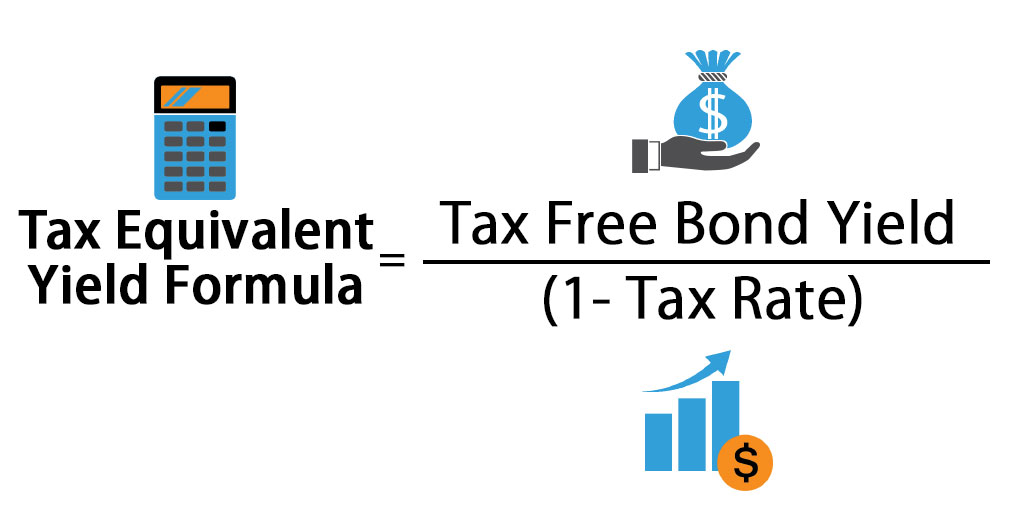

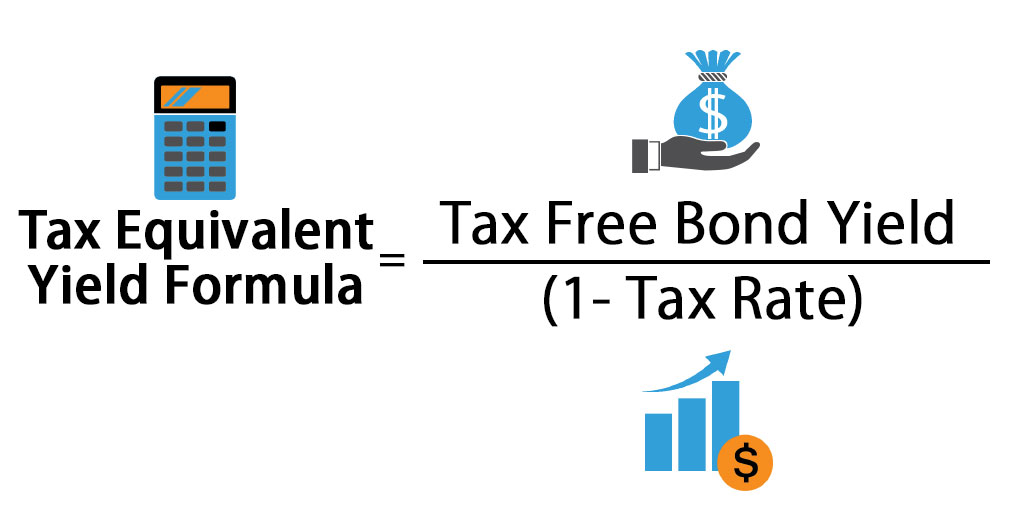

Tax Equivalent Yield Definition

Download Schedule B Calculator Excel Template Exceldatapro Excel Templates Calculator Schedule

1

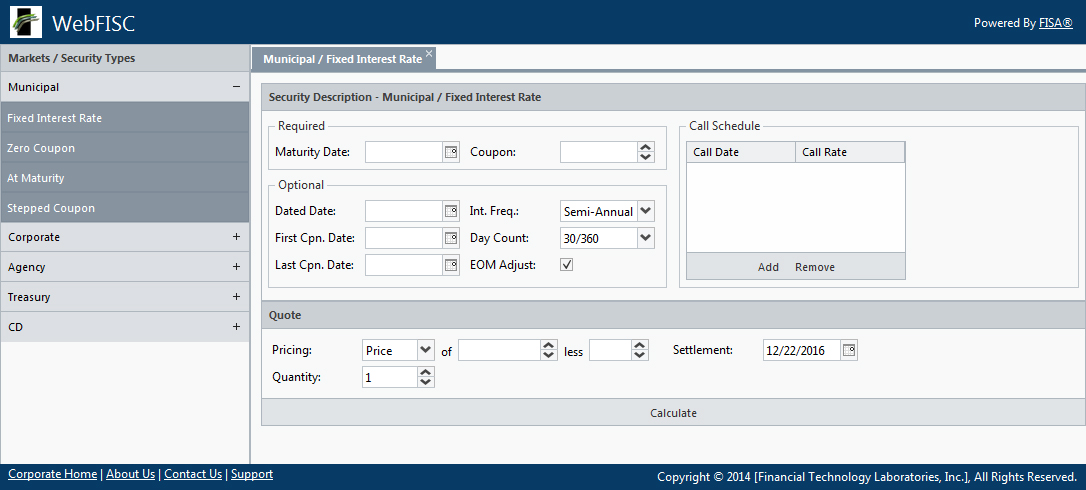

Municipal Bond Calculator Fisa Fixed Income Security Analytics

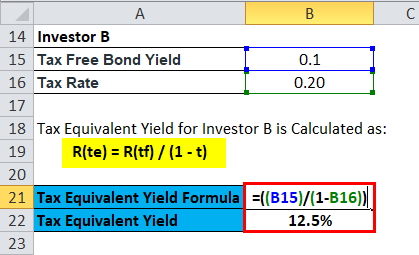

Tax Equivalent Yield Formula Calculator Excel Template

Bankrate Com Provides A Free Tax Equivalent Yield Calculator And Other Tey Calculators To View The Yield Of Your Municipal Bonds Calculator Tax Tax Free

Download Schedule B Calculator Apple Numbers Template Exceldatapro Number Templates Templates Apple

Municipal Bond Calculator Muni Bond Yield Calculator

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Tax Equivalent Yield Formula Calculator Excel Template

/GettyImages-689019164-fb16a968ac1e44e69b1a7013180aba7b.jpg)

Municipal Bonds Vs Taxable Bonds And Cds

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition